Understanding Life Insurance for Families: A Comprehensive Guide

Introduction to Life Insurance for Families

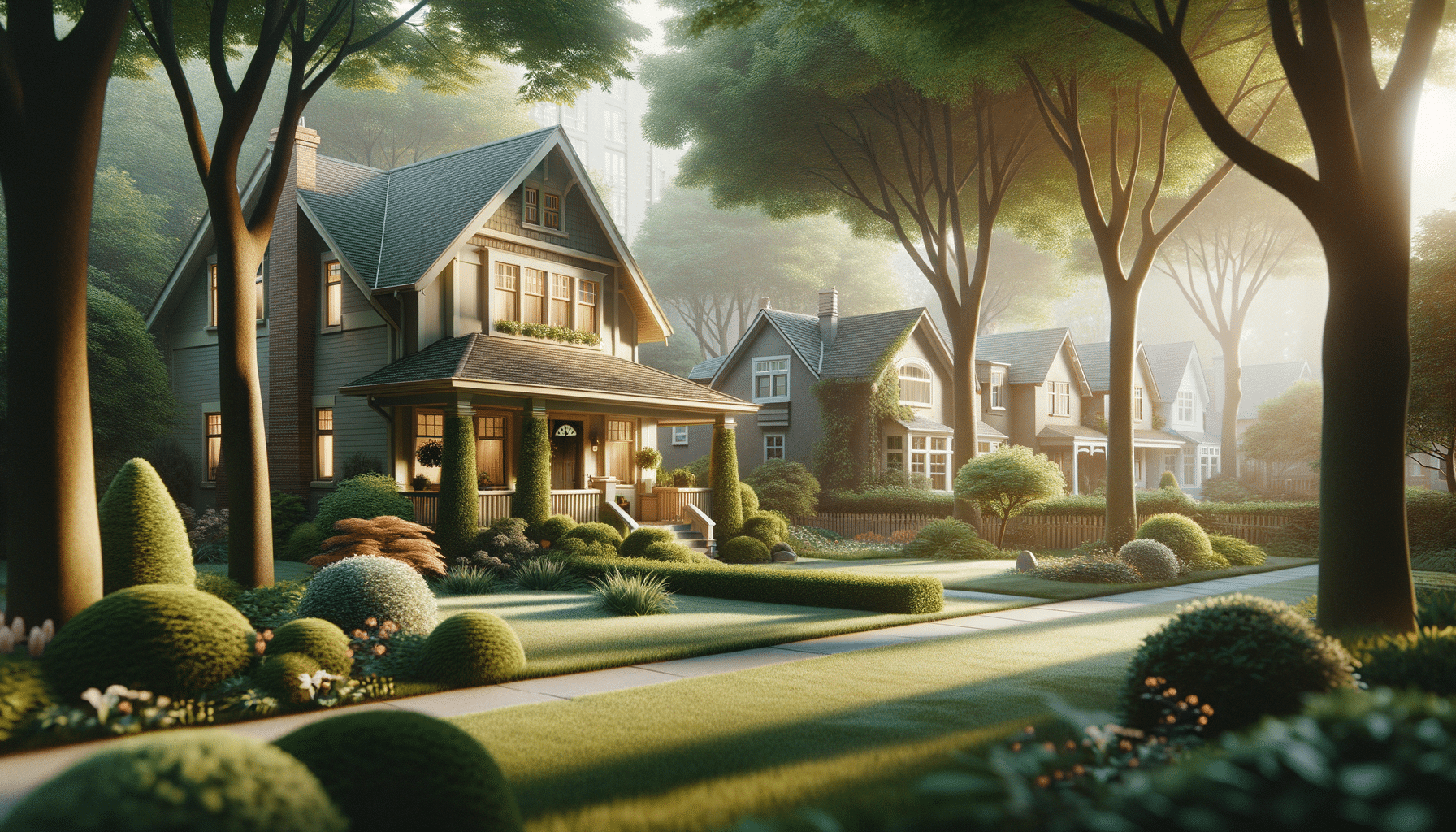

In the intricate tapestry of life, ensuring the financial security of your loved ones is a significant concern. Life insurance for families offers a safety net that can provide peace of mind amid life’s uncertainties. As families grow and evolve, so do their financial responsibilities and commitments. Life insurance serves as a vital tool to manage these responsibilities, ensuring that your family is protected even in your absence.

Life insurance policies are designed to offer financial support to beneficiaries upon the policyholder’s death, helping cover expenses such as mortgages, education, and daily living costs. This article delves into the nuances of life insurance for families, exploring its importance, types, benefits, and considerations to help you make informed decisions.

The Importance of Life Insurance for Families

Life insurance is more than just a financial product; it’s a promise of security to your family. In the event of an untimely death, life insurance can help mitigate the financial burden left behind. It ensures that your loved ones can maintain their standard of living, cover outstanding debts, and meet future financial goals.

Consider the scenario of a family with young children. The sudden loss of an income earner can disrupt the family’s financial stability. Life insurance can act as a financial cushion, providing funds to cover educational expenses, daily needs, and even future investments like college tuition. It helps preserve the family’s financial independence, allowing them to focus on healing rather than financial stress.

Moreover, life insurance can be an essential part of estate planning, ensuring that your assets are distributed according to your wishes while minimizing potential tax implications. For families, it represents a commitment to safeguarding their future, no matter what life throws their way.

Types of Life Insurance Policies

When it comes to life insurance, several types cater to different needs and financial goals. Understanding these options can help families choose the most suitable coverage.

- Term Life Insurance: This is a straightforward policy that provides coverage for a specific period, usually 10, 20, or 30 years. It is typically more affordable and is ideal for families looking to cover temporary financial obligations like a mortgage or children’s education.

- Whole Life Insurance: Offering lifetime coverage, this type of policy combines a death benefit with a cash value component. It can serve as a long-term financial planning tool, although it tends to be more expensive than term insurance.

- Universal Life Insurance: This flexible policy allows for adjustments in premium payments and death benefits. It also includes a savings component that can accumulate over time, providing an opportunity for investment growth.

- Variable Life Insurance: Combining insurance with investment options, this policy allows policyholders to invest the cash value in various accounts, potentially increasing the policy’s value. However, it also comes with investment risks.

Each type of policy has its advantages and drawbacks, making it crucial for families to assess their financial situation, future needs, and risk tolerance before making a choice.

Benefits of Life Insurance for Families

Life insurance provides numerous benefits that extend beyond mere financial protection. One of the primary advantages is the ability to replace lost income, ensuring the family’s financial obligations are met without interruption. This can include mortgage payments, utility bills, and other essential expenses.

Another significant benefit is the potential to cover end-of-life expenses. Funerals and related costs can be substantial, and life insurance can alleviate this burden from grieving family members, allowing them to focus on emotional recovery. Additionally, life insurance can facilitate wealth transfer, enabling policyholders to leave a legacy for their heirs.

For families with dependents, life insurance can also serve as an educational fund, ensuring that children have the resources to pursue higher education, irrespective of unforeseen circumstances. This aspect of life insurance can provide parents with the peace of mind that their children’s future is secure.

Moreover, certain life insurance policies offer living benefits, allowing policyholders to access a portion of the death benefit in case of a terminal illness diagnosis. This flexibility can provide financial support during challenging times, further enhancing the policy’s value.

Considerations When Choosing Life Insurance

Selecting the right life insurance policy requires careful consideration of several factors. Families should begin by evaluating their financial situation, including current income, debts, and future financial goals. Understanding these elements can help determine the appropriate coverage amount needed to secure the family’s financial future.

Another critical consideration is the policy’s premium cost. It’s essential to choose a policy that fits within the family’s budget without compromising other financial priorities. Comparing different policies and providers can help identify the most cost-effective option.

Families should also consider the policy’s flexibility. Some policies offer options to adjust coverage and premiums over time, which can be beneficial as financial needs evolve. Additionally, understanding the policy’s terms and conditions, including any exclusions or limitations, is crucial to ensure that the coverage aligns with the family’s expectations.

Finally, seeking advice from a financial advisor or insurance professional can provide valuable insights and guidance. These experts can help families navigate the complexities of life insurance, ensuring that they make informed decisions that align with their unique needs and circumstances.