Understanding Homeowners Insurance Coverage

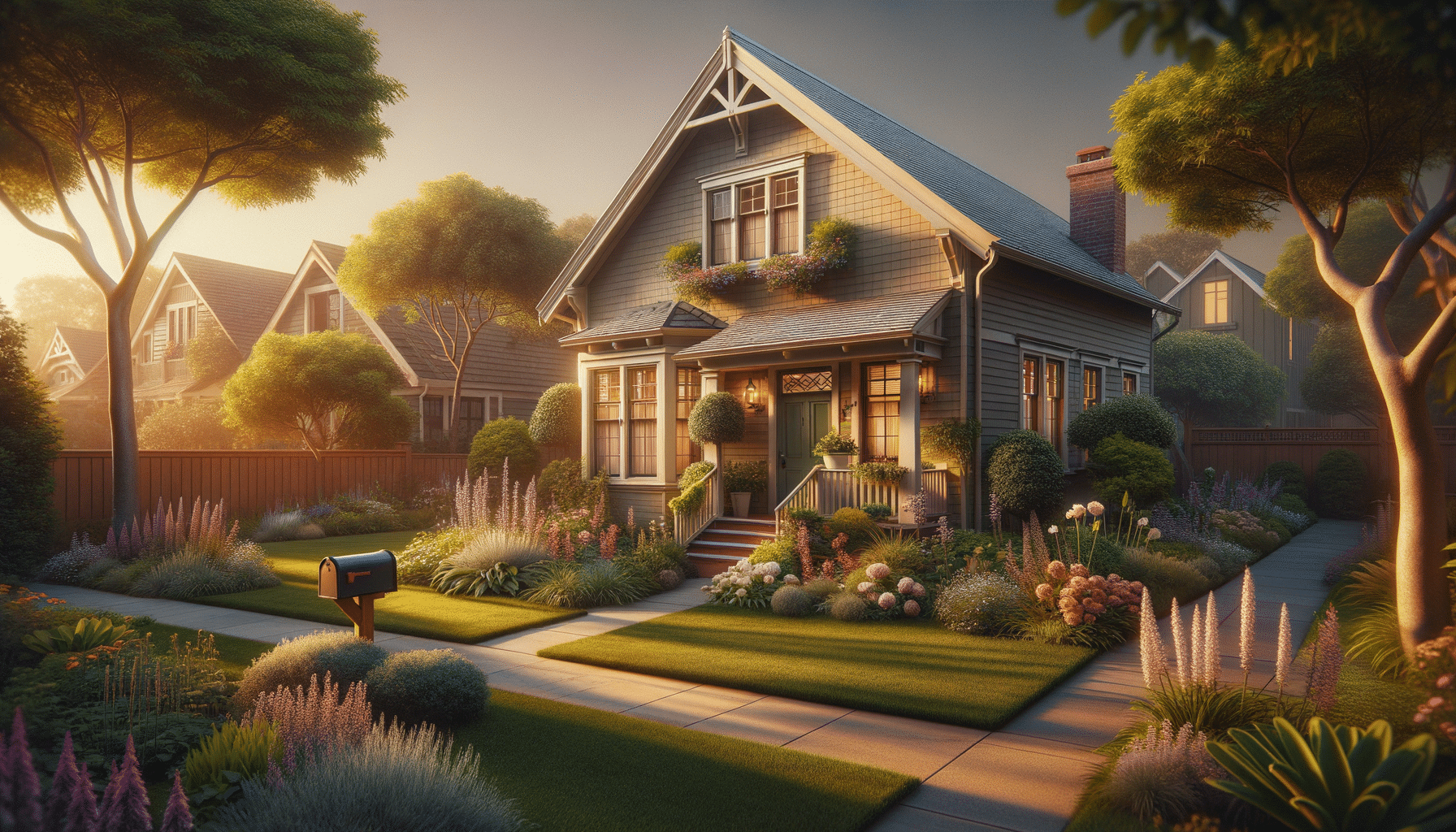

Introduction to Homeowners Insurance Coverage

Homeowners insurance is a crucial aspect of owning a home. It not only protects your property but also provides peace of mind in the face of unforeseen events. Understanding the intricacies of homeowners insurance coverage can significantly impact how you manage risks related to your property. This guide aims to shed light on the various facets of homeowners insurance, ensuring you are well-equipped to make informed decisions.

What Does Homeowners Insurance Cover?

Homeowners insurance typically covers a range of incidents that can damage your home or personal belongings. These policies generally include:

- Dwelling Coverage: This protects the structure of your home, including walls, roof, and built-in appliances.

- Personal Property Coverage: Offers protection for your personal belongings, such as furniture, electronics, and clothing, against theft or damage.

- Liability Protection: Covers legal costs if someone is injured on your property and decides to sue.

- Additional Living Expenses (ALE): Pays for temporary living costs if your home becomes uninhabitable due to a covered event.

Understanding these components is vital to ensuring comprehensive protection. Each policy is unique, so it’s important to read the terms carefully to know what is specifically covered.

The Importance of Homeowners Insurance

Homeowners insurance plays a critical role in safeguarding your financial investment. Without it, you could face significant out-of-pocket expenses in the event of damage or loss. Here are some reasons why homeowners insurance is essential:

- Financial Protection: It mitigates the financial burden associated with repairing or rebuilding after a disaster.

- Legal Requirement: If you have a mortgage, your lender will likely require you to carry homeowners insurance as part of the loan agreement.

- Peace of Mind: Knowing that you have coverage can provide peace of mind, allowing you to focus on other aspects of homeownership.

In essence, homeowners insurance is not just a protective measure but also a requirement for securing a mortgage, making it an indispensable part of homeownership.

Factors Affecting Homeowners Insurance Premiums

Several factors influence the cost of homeowners insurance premiums. Understanding these can help you manage costs effectively:

- Location: Homes in areas prone to natural disasters like floods or earthquakes may have higher premiums.

- Home Value and Construction: The cost to rebuild your home and the materials used can affect premiums.

- Deductible Amount: A higher deductible can lower your premium, but you’ll pay more out-of-pocket in case of a claim.

- Credit Score: Insurers often use credit scores to assess risk, impacting premium costs.

By being aware of these factors, homeowners can take steps to potentially lower their insurance costs, such as improving home security or increasing the deductible.

Choosing the Right Homeowners Insurance Policy

Selecting the right homeowners insurance policy requires careful consideration of your needs and circumstances. Here are some tips to guide you:

- Evaluate Coverage Needs: Assess the value of your home and personal belongings to determine adequate coverage levels.

- Compare Policies: Shop around and compare quotes from different insurers to find a policy that fits your budget and needs.

- Understand Policy Exclusions: Be aware of what is not covered, such as certain natural disasters, and consider additional coverage if necessary.

- Review Annually: Regularly review your policy to ensure it still meets your needs, especially after major life changes or home improvements.

By taking these steps, you can ensure that you select a homeowners insurance policy that provides the necessary protection for your home and assets.

Conclusion: The Value of Comprehensive Homeowners Insurance

In conclusion, homeowners insurance is a vital component of protecting your home and financial stability. By understanding the coverage options, the importance of maintaining insurance, and the factors affecting premiums, homeowners can make informed decisions. Regularly reviewing and updating your policy ensures it remains aligned with your evolving needs. Ultimately, comprehensive homeowners insurance offers peace of mind, knowing that your most significant investment is safeguarded against potential risks.