Understanding Personal Finance Management Tools

Introduction to Personal Finance Management Tools

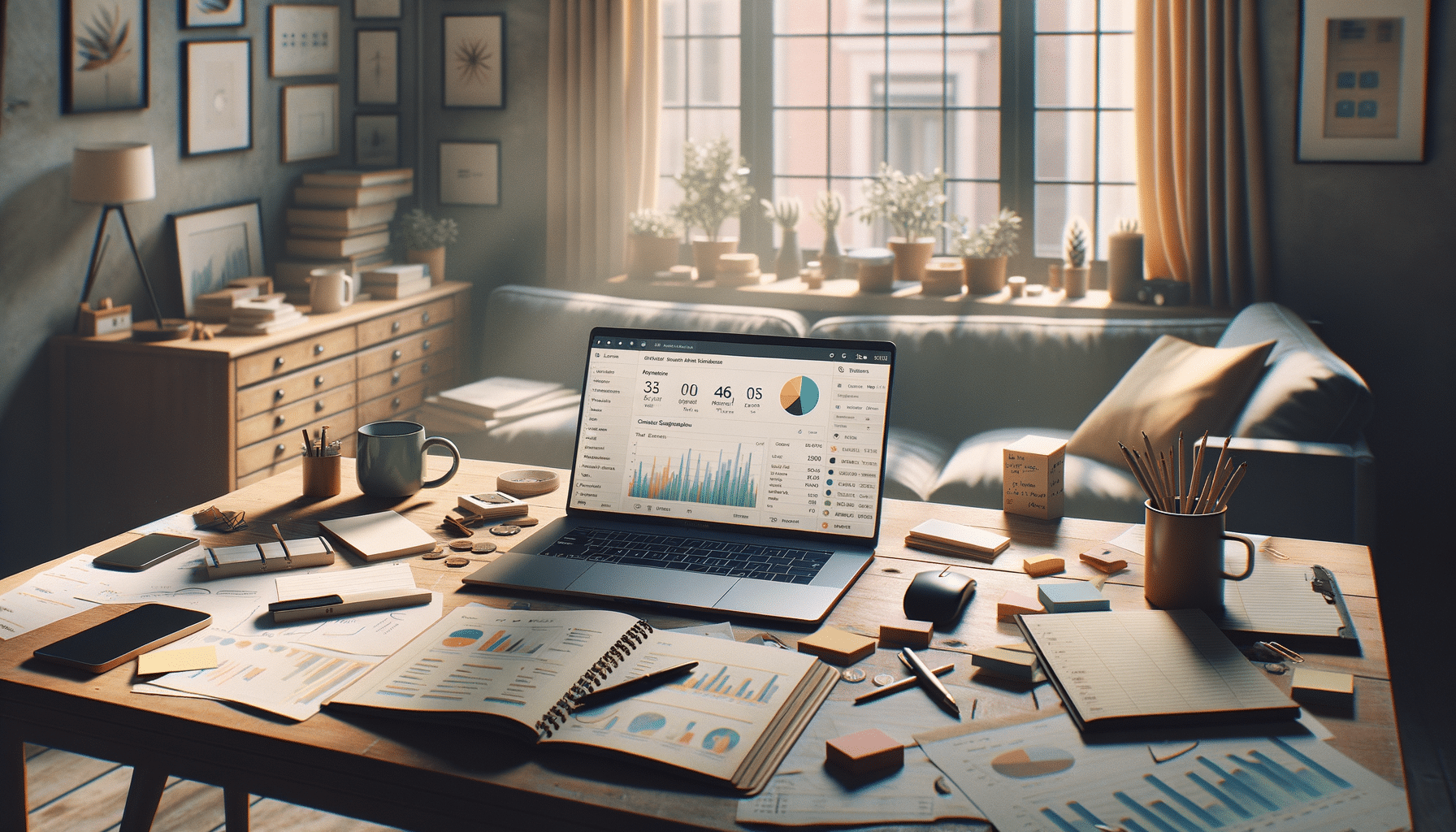

In today’s fast-paced world, managing personal finances effectively is more crucial than ever. With the myriad of financial decisions we face daily, having a robust system to track and manage our finances can be a game-changer. Personal finance management tools offer a structured approach to handle your income, expenses, savings, and investments. These tools are designed to simplify financial tasks, allowing individuals to achieve their financial goals with greater ease and efficiency.

Personal finance management tools are not just about tracking expenses; they provide comprehensive insights into your financial health. By using these tools, you can set budgets, monitor spending patterns, and even plan for future financial needs. This article delves into the various aspects of personal finance management tools, highlighting their importance and how they can be leveraged to enhance financial well-being.

Features of Personal Finance Management Tools

Personal finance management tools come with a variety of features designed to cater to different financial management needs. These features often include budgeting, expense tracking, and financial goal setting. Budgeting tools help users allocate their income towards various spending categories, ensuring that they do not overspend. By tracking expenses, users can gain insights into their spending habits and identify areas where they can cut costs.

Another prominent feature is financial goal setting, which allows users to plan for future financial milestones like buying a house, saving for retirement, or planning a vacation. Many tools also offer investment tracking, enabling users to monitor their portfolios and make informed investment decisions. Some advanced tools even provide financial insights and recommendations based on users’ financial data, helping them optimize their financial strategies.

By integrating features like bill reminders and payment alerts, these tools ensure that users never miss a due date, thereby avoiding late fees and maintaining a healthy credit score. The ability to sync with bank accounts and credit cards further simplifies the process, providing a holistic view of one’s financial standing.

Benefits of Using Personal Finance Management Tools

The benefits of using personal finance management tools are manifold. Firstly, they offer unparalleled convenience by consolidating all financial information in one place. This centralization makes it easier to access and manage finances without the need for multiple spreadsheets or documents. Additionally, these tools provide real-time updates, allowing users to make timely financial decisions.

Another significant benefit is the enhanced financial awareness they provide. By constantly monitoring financial activities, users become more conscious of their spending habits. This awareness can lead to better financial decisions and improved financial discipline. Moreover, the ability to set and track financial goals encourages users to save more and spend wisely, ultimately leading to financial stability.

Security is also a major advantage. Many personal finance tools use encryption and other security measures to protect users’ financial data, offering peace of mind. This is particularly important in today’s digital age, where data breaches are a common concern.

Choosing the Right Personal Finance Management Tool

With a plethora of personal finance management tools available, choosing the right one can be daunting. It’s essential to select a tool that aligns with your financial needs and goals. Consider factors such as ease of use, features offered, and compatibility with your financial institutions. Some tools are more suitable for budgeting, while others excel in investment tracking or financial planning.

Another important consideration is the cost. While many tools offer free versions, premium features often come at a price. Evaluate whether these additional features justify the cost based on your financial management needs. User reviews and ratings can also provide valuable insights into a tool’s effectiveness and reliability.

Lastly, ensure that the tool you choose offers robust security measures to protect your financial information. Look for tools that use encryption and have a good reputation for safeguarding user data.

Conclusion: Empowering Financial Decision-Making

In conclusion, personal finance management tools are invaluable assets for anyone looking to gain control over their financial life. They offer a comprehensive solution to track, manage, and optimize personal finances, ultimately empowering users to make informed financial decisions. By understanding the features, benefits, and selection criteria of these tools, individuals can choose the right tool to meet their financial objectives and enhance their financial well-being.

As technology continues to evolve, these tools are becoming more sophisticated, offering even more features to help manage complex financial landscapes. Embracing these tools can lead to improved financial literacy and a brighter financial future.